This 2017 cumulative supplement captures the latest regulatory developments for easy reference with coverage of tax exempt. Tax law and compliance 5 th edition provides clarification expert insight and helpful instruction for executives and supporting professionals navigating extensive federal tax law requirements.

Taxing Times Volume 14 Issue 3 October 2018

Private foundations provides an authoritative reference and extensive analysis of tax law and compliance in the private foundations arena with a wealth of practical tools to streamline applications filing and reporting.

Private Foundations Tax Law And Compliance 2007 Cumulative Supplement Free. This 2016 cumulative supplement captures the latest regulatory developments for easy reference with coverage of tax exempt. The must have tax law reference for private foundations updated for 2016 private foundations provides an authoritative reference and extensive analysis of tax law and compliance in the private foundations arena. Find helpful customer reviews and review ratings for private foundations.

Tax law and compliance 2016 cumulative supplement wiley nonprofit authority bruce r. Despite their relatively low numbers private foundations are subject to complex burdensome regulations that continue to expand. Private foundations provides an authoritative reference and extensive analysis of tax law and compliance in the private foundations arena with a wealth of practical tools to streamline applications filing and reporting.

This 2017 cumulative supplement captures the latest regulatory developments for easy reference with coverage of tax exempt status the self dealing rules mandatory distribution jeaopardizing investments taxable expnditures annual reporting to the irs winding up a. Tax law and compliance 2015 cumulative supplement wiley nonprofit law finance and management series by bruce r. Free shipping on qualifying offers.

Make sense of the new regulatory requirements with expert clarification and practical tools for compliance. Private foundations provides an authoritative reference and extensive analysis of tax law and compliance in the private foundations arena with a wealth of practical tools to streamline applications filing and reporting. Free shipping on qualifying offers.

The recent tax overhaul has compounded. The must have tax law reference for private foundations updated for 2017 private foundations provides an authoritative reference and extensive analysis of tax law and compliance in the private read more. Read honest and unbiased product reviews from our users.

Tax law and compliance private foundations. Employment taxes for exempt organizations links to information about employment taxes for tax exempt organizations. Private foundations 2007 cumulative supplement.

Private foundations manual scroll down the table of contents for the internal revenue manual to reach the private foundations manual procedures the irs uses to administer the tax law rules that apply to private foundations. Tax law and compliance 2012 cumulative supplement. Tax law and compliance 2015 cumulative supplement private foundations.

Jim Amell And Kristin Lebrou To Speak At 2019

Jim Amell And Kristin Lebrou To Speak At 2019

The Law Of Tax Exempt Organizations Bruce R Hopkins

The Law Of Tax Exempt Organizations Bruce R Hopkins

National Tax Laws Part I International Taxation Of Trust

National Tax Laws Part I International Taxation Of Trust

Explaining Italian Tax Compliance A Historical Analysis

Explaining Italian Tax Compliance A Historical Analysis

Jim Amell And Kristin Lebrou To Speak At 2019

Jim Amell And Kristin Lebrou To Speak At 2019

Explaining Italian Tax Compliance A Historical Analysis

Explaining Italian Tax Compliance A Historical Analysis

The Impact Of Pikettys Wealth Tax On The Poor The Rich

The Impact Of Pikettys Wealth Tax On The Poor The Rich

Decarceration Strategies How 5 States Achieved Substantial

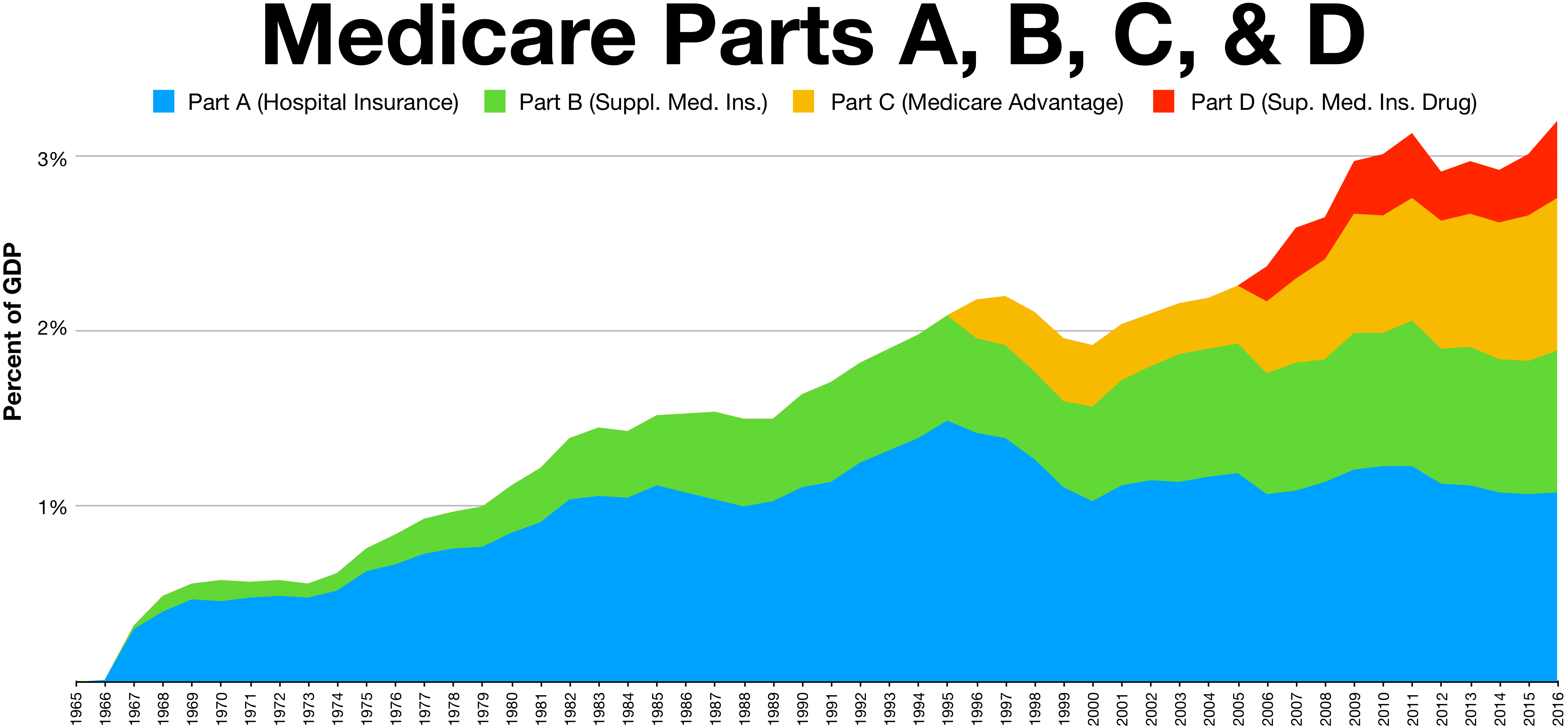

Taxes Just Facts

Assessing Individual Intellectual Output In Scientific

Taxprof Blog

Taxprof Blog

博客來 Private Foundations Tax Law And Compliance 2007

博客來 Private Foundations Tax Law And Compliance 2007

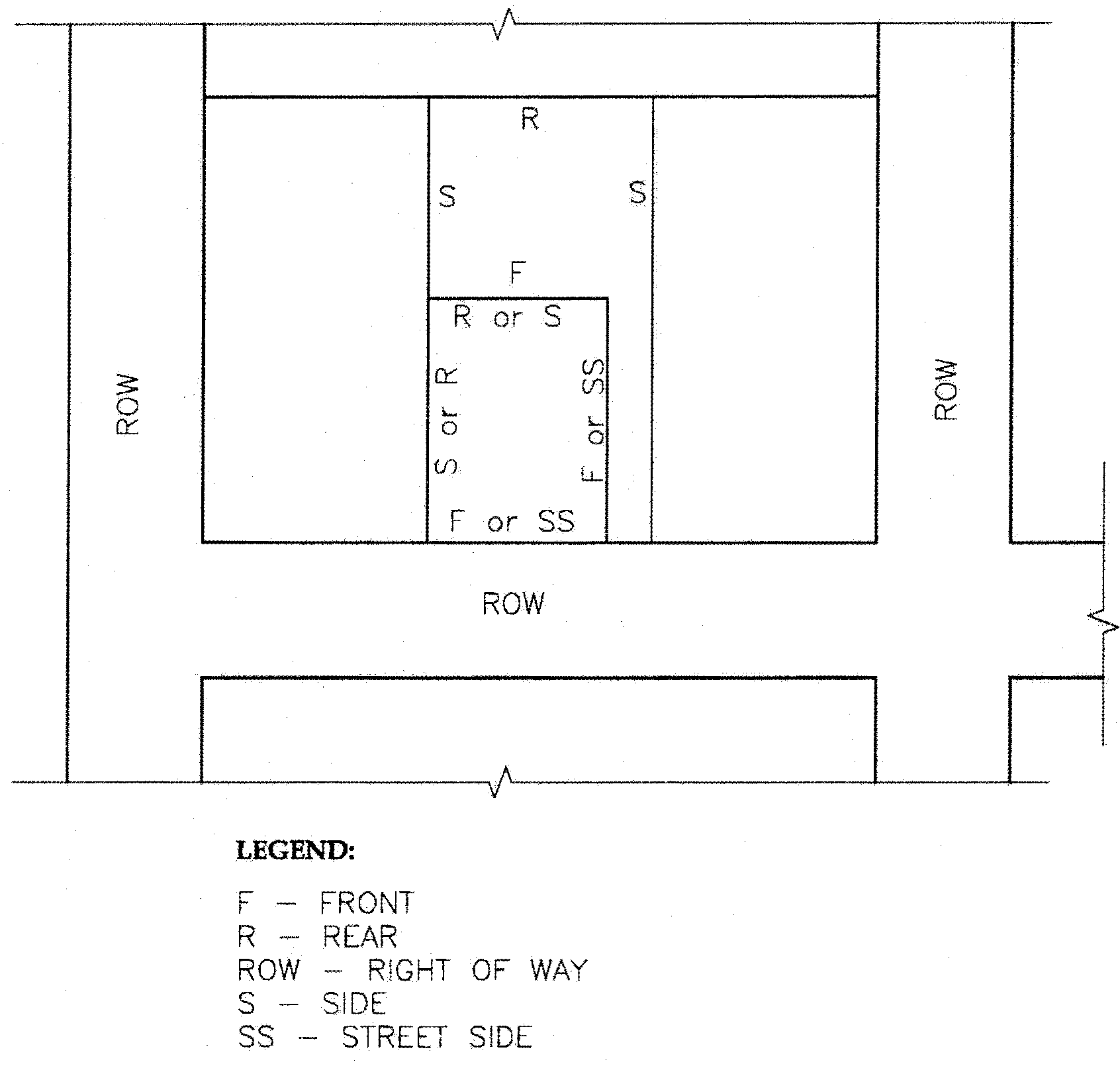

Chapter 4915 Permits Code Of Ordinances Juneau Ak

Chapter 4915 Permits Code Of Ordinances Juneau Ak

Iraq Selected Issues

Decarceration Strategies How 5 States Achieved Substantial

0 Response to "Private Foundations Tax Law And Compliance 2007 Cumulative Supplement Book Pdf"

Posting Komentar