While tax rules for freelancers can be complex self employed persons can generally write off expenses that fall into three categories. Here are 10 possible tax deductions that every freelancer should know about.

/GettyImages-481518099-5c5c983fc9e77c00010a47cc.jpg) What Is An Independent Contractor

What Is An Independent Contractor

Unlike those suckers with full time jobs self employed workers can take the home office deduction and its associated direct and indirect expenses without having to itemize.

Tax Deductions A To Z For Freelance And Contract Workers Pdf Download. In addition to regular income tax freelancers are responsible for paying the self employment tax of 153. Things you use exclusively in operating your business. Hobbies are not allowed to show a loss whereas a business can deduct all business relates expenses even if it results in a loss within reason.

The irs describes this as an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. The irs only allows deductions up to the amount the hobby earned. However while self employment tax filing does require a few more steps it can also mean greater tax savings.

If youre not registered for tax then youre paying your 25 tax and not claiming any deductions. Here is a basic primer about taxes for the self employed. En español last years major tax overhaul shook things up for freelancers gig workers and sole proprietors who now are starting to wonder about how the new law will affect their taxable income for 2018.

If you made 1000 with your jewelry and your expenses were 1500 you can only deduct up to 1000. The tax deductions available to businesses are also available to independent contractors if the expense relates to an income producing activity. These expenses can all be deducted on schedule c form 1040 unless otherwise noted.

Things you eat in the course of doing business. Basically you can still get that sweet standard deduction plus the deduction for the associated costs of your home office. Tax deductions for contract employees.

Things related to the exclusive business use of the place where your business operates. It is an annual allowance for the wear and tear deterioration or obsolescence of the property this can be an important deduction for freelancers who make a living using expensive equipment like laptops and cameras. However these deductions are not available to contract employees who are temporarily on a companys payroll.

Phone bills or stationary may all be tax deductions. Eight things you need to consider. This tax represents the social security and medicare taxes that ordinary employees have taken out of their paychecks automatically.

For freelance and contract workers last years tax overhaul potentially brings big savings with new business deductions. Nothing eases the pain of tax time like a long list of deductions. Not wanting the hassle of more complicated taxes is what keeps many from taking contract or freelance work or starting a home business.

So the best advice we can give is if you do freelance work outside south africa you should probably consult with a tax. Employee contractors are eligible to deduct. Im not a tax expert.

Before you file your 2014 return check below to make sure youre claiming every deductible available to your freelance business and keep more of that hard earned money in your pocket.

Working As A Freelancer In Germany From A To Z Mawista Blog

Working As A Freelancer In Germany From A To Z Mawista Blog

The Top 6 Books On Tax And Bookkeeping For Small Business

The Top 6 Books On Tax And Bookkeeping For Small Business

Amazoncom 475 Tax Deductions For Businesses And Self

Amazoncom 475 Tax Deductions For Businesses And Self

Publication 505 2019 Tax Withholding And Estimated Tax

Publication 505 2019 Tax Withholding And Estimated Tax

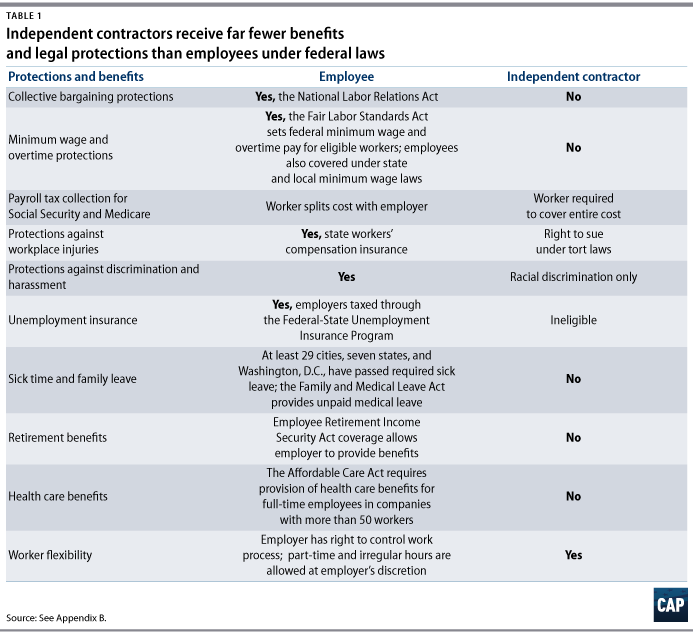

Raising Pay And Providing Benefits For Workers In A

Raising Pay And Providing Benefits For Workers In A

Amazoncom 475 Tax Deductions For Businesses And Self

Amazoncom 475 Tax Deductions For Businesses And Self

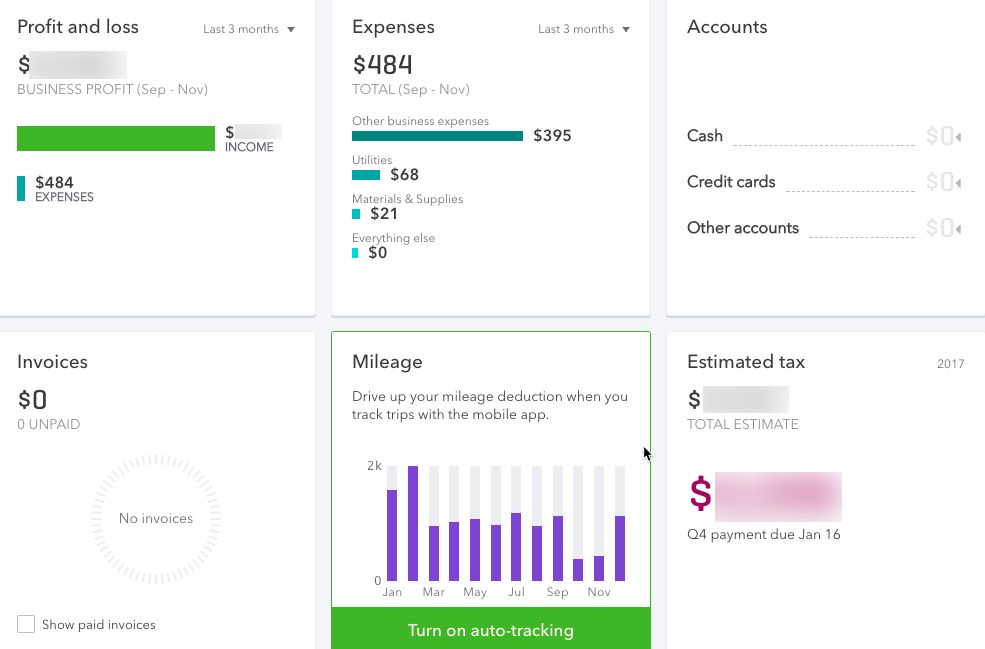

The Best Accounting Software For Freelancers In 2019

The Best Accounting Software For Freelancers In 2019

Publication 17 2018 Your Federal Income Tax Internal

Publication 17 2018 Your Federal Income Tax Internal

The New Qbi Deduction Is Finally Clearer Journal Of

The New Qbi Deduction Is Finally Clearer Journal Of

Oecd Ilibrary Home

Oecd Ilibrary Home

Publication 225 2018 Farmers Tax Guide Internal

Publication 225 2018 Farmers Tax Guide Internal

Top Tax Write Offs And Deductions For Freelance And Work

Top Tax Write Offs And Deductions For Freelance And Work

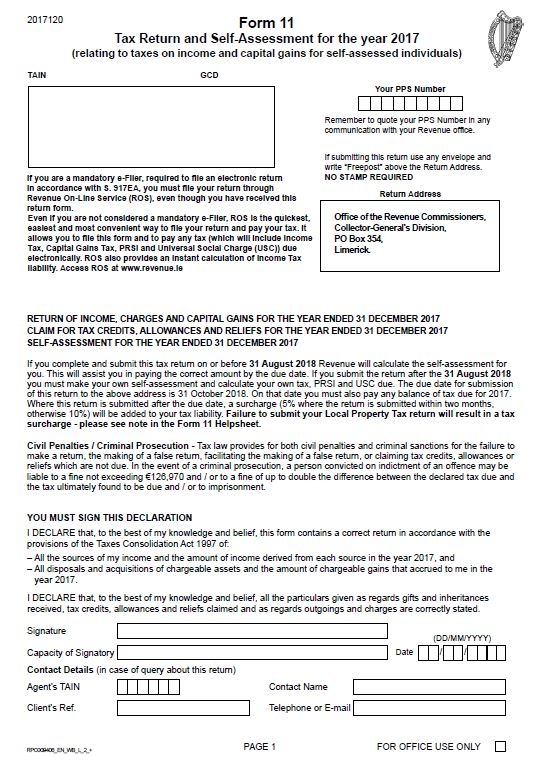

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

0 Response to "Tax Deductions A To Z For Freelance And Contract Workers Book"

Posting Komentar